Multi Signature Contracts

Digital Asset Storage

Digital asset storage and related custody services are the most vital concepts in the new era of web3. A user’s identification and authentication depends on the ownership of his/her wallet. Web3 wallets store a user’s cryptocurrency, NFTs or other digital assets and often has a user-friendly interface that can easily connect and interact with decentralized applications (DApps) on various blockchains. A web3 wallet owner has a private key or seed phrase that is dedicated to that wallet. Their account is only accessible with the private key or seed phrase, which cannot be changed. As people continue to grow their portfolios and assets, they need a reliable wallet to keep their assets safe.

Why Multi Signature?

What if you have a company with multiple partners, or you have a family asset that is inherited to children of the family, so that there is more than one owner? Who will keep the wallet? How will the trust be established?

These cases show that key management can be a burden, one solution for storing Ether and Ethereum-based tokens is by having multiple people hold ownership of one address or set of funds.

A multi-signature contract is actually a “wallet” as it can hold and transfer funds. As you can guess, it needs more than one signature to approve any wallet activity such as transferring funds out. Since multi-sigs are powered by multiple keys, they avoid a single point of failure, which makes it significantly harder for the funds to be compromised. This design provides a higher degree of security against lost or compromised keys.

Multisig contracts;

Share responsibility of ownership of an address and its funds between multiple people like;

Businesses/ Organizations: Business Expenses, Treasury Management, Asset Protection

Families: Inheritance, Wills

Avoid a single point of failure, which makes it significantly harder for funds to be compromised.

Split responsibility of ownership of an address and its funds between multiple people.

If multiple keys are used and only a set percentage for consensus of a transaction has to be met, a lost key/seed wouldn’t render the wallet useless or inaccessible.

How does it work?

Multi signature requires a majority share of owners need to approve the transaction that is to be sent. If you have funds that are shared amongst 5 different individuals, then you require 2, 3, 4 or 5 signatures to execute a transaction.

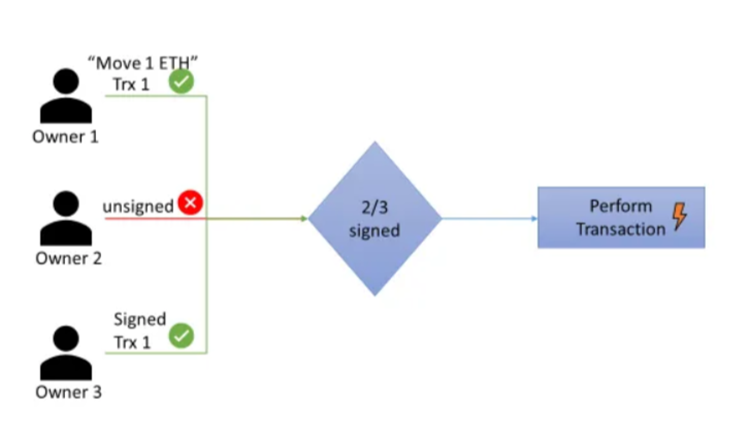

Let’s say we have a team containing three people. The team decides to configure this multisig contract to require a majority share of approvals, which means that at least two people need to approve a transaction before it is sent from the Multi-Sig.

Above you can see that owner 1 sends a transaction(Trx 1) from the multisig contract. Owner 1 tells the Multi-Sig contract to send 1 ETH , but since this contract requires a majority share of approvals, the 1 ETH is not sent directly. Another owner in their team has to approve the transaction and afterwards, 1 ETH is immediately sent to the address that the first owner chose.

So owner 3 has confirms the transaction(Trx 1) that owner 1 submitted. Since this Multi-Sig only requires 2 confirmations, the transaction is executed.

The pitfall in this scenario is that if owner 2 didn’t want the transaction to execute, or perhaps owner 1 and 3 were both hacked. If you lower the confirmations to 1, it only requires one compromised owner to lose funds. If you raise the confirmations to 3, one owner losing their key will result in the funds being locked forever. Ultimately, the number of confirmations is up to the group’s discretion and should satisfy the needs of the group.

Obviously if you oblige few signatures, it will make it easier to move funds, although you risk funds being moved without the entire groups consent.

You will increase security if you oblige more signatures. But on the other hand, with a higher amount of signatures you have the risk that losing private keys may cause the funds to be immovable.

Conclusion

Multisignature wallets provide critical and essential functionalities for most of the asset ownership use-cases. With the need for multiple private keys for signing transactions, the Multi-Sig wallets provide assurance of better security. Nevertheless, the majority share of approvals scenarios should be thought and implemented carefully in order not to face losses.

If you are a team that manages funds, a Multi-Sig is what you are looking for. It will not only make your funds safer but increase the transparency and trustlessness of your organization. In the complex environment of digitilization, Multi-Sig wallets will serve as a crucial component for driving the adoption of digital asset ownership and custody services in the future.