23OCT

REAL WORLD ASSET TOKENIZATION

Tokenization is a rapidly developing area in the financial industry which enables investment in the form of digital tokens backed by real world securities or assets. It leverages blockchain technology to create a more open and accessible financial system. The blockchain based digitalization of finance can result in better transparency, and it can lower transaction costs by eliminating many of the intermediaries needed to facilitate financial transactions. It can also lower the cost of financing and make financial services more inclusive. The tokenization process marks a promising solution in converting rights to an asset into a unique digital representation as a token. Leveraging the secure, immutable qualities of blockchain technology, tokenization facilitates digital fractional ownership with secure transaction records and swift settlement processes. And also Tokenization has a big potential. Industry experts have forecast up to $5 trillion in tokenized digital-securities trade volume by 2030.What is tokenization?

Tokenization is the process of issuing a digital representation of an asset on a blockchain. Each token represents a fraction of ownership in the underlying asset, enabling investors to buy, sell, or trade these tokens on digital asset marketplaces. Tokenization facilitates the sharing and ownership of unique assets.

Benefits of tokenization

1. Lower transaction and operational costs

Tokenizing assets can significantly reduce transaction costs, as it streamlines the process of asset transfer and eliminates intermediaries.This reduction in fees and administrative expenses makes investing in tokenized assets more cost-effective for both investors and asset owners. Smart contracts can automatize infrastructure fund management way beyond the existing solutions available. They can deliver efficiency gains in operations both at the level of the project and in the entity managing the asset. By streamlining IT systems, sharing the infrastructure between all participants and without requiring the involvement of a central third party, transaction costs are significantly reduced. 24/7 data availability and asset programmability is particularly useful for asset classes where servicing or issuing tends to be highly manual and hence error-prone, such as corporate bonds. Embedding operations such as interest calculation and coupon payment into the smart contract of the token would automate these functions and require less hands-on human effort.The digitalization and automation of manual work along with the reduction of a part of the reconciliation / compliance work also enable to cut inefficiencies.

2. Fractionalization

By allowing to fractionalize assets and to own and perform actions over only a portion of an asset, DLT / Blockchain enables a greater liquidity. By cutting down barriers to investment, a wider range of people can buy / invest in assets. In traditionally rather illiquid markets (e.g. real estate, fine art) this technology can help sellers to find more easily an counterpart to perform a transaction. If there is no minimum project size, investors would be able to construct portfolios with a very specific type of infrastructure exposure. For example, an investor might want to build a portfolio, buying infrastructure in city A, profiting from a price increase, and short selling infrastructure in city B, profiting from a price decrease. Tokenization can enable a completely new level of portfolio construction with the ability to gain very specific investment exposure. Fractionalization enables flexible portfolio construction and diversification; operational efficiency and reduced settlement time allows faster transfer of investment interests; and data transparency brings updated information for investment analysis. By tokenizing small-scale infrastructure, due diligence and transaction costs can be significantly decreased, as outlined earlier. This enables cost-efficient bundling through tokenizing a portfolio of assets or even individual projects.

3. Faster transaction settlement

At present, most financial settlements occur two business days after the trade is executed (or T+2); in theory, this is to give each party time to get their documents and funds in order. The instant and 24/7 settlements made possible by tokenization could translate to significant savings for financial firms in high-interest-rate environments. Transactions in tokenized products can be settled almost instantly, unlike the days or weeks that it can sometimes take to settle traditional finance transactions. Blockchain technology enables rapid settlement of transactions, speeding up the process of buying and selling assets. This efficiency reduces the time it takes for asset transfers to be completed, leading to increased market activity.

4. Enhanced Security

Blockchain’s inherent features protect tokenized assets from fraud and cyber attacks. As blockchain records are immutable and publicly accessible, investors can verify the history and authenticity of assets, reducing the risk of fraud.

5. Enhanced transparency

Tokenization brings transparency to asset ownership and transactions. The transparent nature of blockchain also minimizes the risk of counterfeit assets entering the market. Blockchain’s main promise of being a “trust machine” is that it can improve transparency and accountability for infrastructure projects by orders of magnitude. It can facilitate and improve the monitoring of financial, operational, social and environmental performance.

6. Increased Liquidity

Tokenization enables liquidity by enabling the secure transfer of shares between investors, with every transaction reflected on the digital ROM. With regulatory regimes worldwide embracing, and establishing frameworks for the regulation of, digital securities exchanges, global public market liquidity for tokenized securities is also well on its way. Infrastructure is an illiquid asset class. Through tokenization, the liquidity of the asset class can be improved by orders of magnitude. It can enable the creation of secondary markets and eliminate the need for the steep liquidity premiums currently priced in by lenders and other investors in the space.

Real world examples

The real world examples are mainly from these sectors:

· Real Estate

· Collectibles & Art

· Carbon Credits

· Financial Assets

· Infrastructure

· Sports Teams & Franchises

· Loyalty Points & Rewards

Tokenestate, for example is dedicated to real estate tokenization. The initiative enables companies and real estate asset managers to issue and efficiently manage blockchain-based digital securities through its platform. It provides a complete set of services to issuers by:

• Providing advisory services on security tokens

• Facilitating fundraising in compliance with securities regulations

• Providing a secondary market for security tokens

• Assisting with KYC and AML compliance

• Enabling the efficient management of a large number of investors through digitizing key investment processes such as compliance with prospectus exemptions, pre-emption rights or casting votes during the general assembly

Smart Valor is a Swiss-based company with a mission to democratize access to wealth. It recently launched its VALOR Platform, a decentralized marketplace for tokenized alternative investments, such as venture capital, private equity, hedge funds, real estate and commodities. This USD 7 trillion multi-asset class is currently only accessible for high-net-worth individuals and institutional investors. Through the VALOR Platform, anybody will be able to invest in these assets.

Mt Pelerin is in the process of becoming a fully regulated and compliant blockchain-based bank. It will tokenize its entire balance sheet: assets, liabilities and equity. It has also developed its own open source security token standard. All deposits will be kept in a highly liquid reserve in a transparent manner on the blockchain. In contrast, traditional banks only have a small part of client deposits readily available, making them vulnerable to bank runs. All banking services will be offered using a marketplace approach. Mt Pelerin will act as a market maker and connect customers and third-party financial service providers. It will be an open platform with easy third-party integration for micro-services. Its revenues will come from the commissions charged for its services and transactions on its marketplace.

Ekofolio, a start-up operating a digital platform allowing users to purchase tokens representing stakes in forests bought and managed by the company’s SPV. These tokens generate relatively stable dividends and potentially increase in value if the timber price or land value rises.

How does an asset get tokenized?

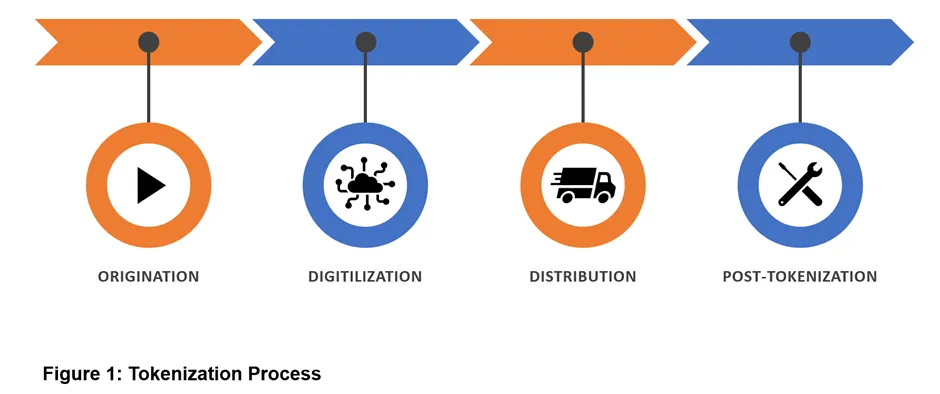

The process of tokenization creates a bridge between real-world assets and their trading, storage and transfer in a digital world using the Blockchain technology.

1. Origination

Identification and selection of the asset to be tokenized. Determine which regulatory frameworks apply and whether the asset will be treated as a security or a commodity.

2. Digitalization

Select the technology platform for tokenization and create digital tokens representing real-world assets using smart contracts and blockchain protocols. This step involves defining the token’s properties, such as divisibility, transferability, and governance rights.

3. Distribution

Distribute tokens to primary investors in exchange for investment capital and store transactional information automatically onto the blockchain without the participation of intermediaries.

4. Post-tokenization

Once the asset has been distributed to the investor, it will require ongoing maintenance. This should include regulatory, tax, and accounting reporting.

Conclusion

There are no intermediaries involved in Decentralised finance applications. The whole application is programmed by means of smart contracts and is fully automated without human or institutional intervention. The basic assumption of Tokenized Finance is that the assets themselves are issued and kept on decentralised or distributed ledgers. Traditional investment involves significant financial commitments, lengthy processes and excessive paperwork. Tokenization addresses these problems by bringing operational efficiencies and information transparency to the transactions and bringing the additional benefits of fractionalized ownership and liquidity to investment sector.