Top Web3 Trends of 2023

There has been rapid developments in web3 technologies and ecosystems that emerged in 2023. While 2022 was one of the more difficult years in crypto’s short history, that doesn’t appear to erode global confidence in the underlying technology. And despite all the recent market turbulence, global financial leaders are still very optimistic and as the market recovers and continues to mature and evolve, so will the applications of crypto and blockchain technology.

The global financial landscape continues to change and evolve, eventually moving towards a world where value moves as smoothly as information today, which is called the Internet of Values. Therefore, when we examine web3 through a broader lens, change is also driven by increased consumer demand and interest in blockchain and digital asset technology, maturing use cases for financial institutions and businesses, and a broader shift towards real-world utility.

Looking at the broader market and industry, six distinctive topics can be seen as driving the change:

1. Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) have gained significant momentum in the past year or so, as central banks are moving from research and exploration to pilot projects on several use cases. One current example of this is the partnership between the Federal Reserve Bank of New York and Monetary Authority of Singapore to explore how a wholesale CBDC could improve the speed and efficiency of cross-border payments involving multiple currencies¹.

According to McKinsey, roughly 90% of the world’s central banks are now pursuing CBDC projects², up from 80% last year. Additionally, Juniper Research forecasts the value of payments via CBDCs to reach $213 billion annually by 2030, up from just $100 million in 2023, representing a massive 260,000% growth rate³. This trend is mainly because of declining cash usage, increasing demand for privately issued digital assets, central banks’ desires to not get left behind in the race to innovation, and the rise in local governance amidst a global payments landscape.

CDBSs are not just a digital form of a national currency, they can support a variety of use cases by their underlying blockchain technology, programming capabilities, and ability to reach anyone with a mobile phone and digital wallet, which also covers the unbanked. Use cases span cross-border payments to micropayments; to peer-to-peer (P2P) lending and government issued relief spending. And because they represent digital forms of national currency, they have the potential to have an extremely powerful impact on economies where the current payments infrastructure is ripe for innovation.

2. Decentralised Metaverses

Gartner predicts that by 2026, 25% of people will spend at least one hour a day in the metaverse for work, shopping, education, social, or entertainment purposes⁴. According to McKinsey, customers expect to spend almost 4 hours per day in the metaverse in 5 years⁵.

Enterprise interest in NFTs and the metaverse has also been on the rise. Nike released a collection of virtual sneaker NFTs with the acquisition of RTKFT⁶ and made headlines with the sale of an NFT sneaker for USD 134,000.70 Mastercard has filed for 15 trademarks in the areas of metaverse and NFT related services, including payments and credit cards⁷. Investor interest has also seen an uptick on metaverse projects. Fidelity Investments launched an exclusive exchange-traded fund to offer investors exposure to metaverse related products and services⁸.

The total addressable market for metaverse related services is projected to be worth between USD 8 trillion and USD 13 trillion, with 5 billion users by 2030, as per reports by Citibank⁹.

Promising advancements in technology and regulations like Zero Knowledge Proofs (ZKPs) play a crucial role in the decentralised Metaverse. A zero-knowledge proof (ZKP) is a method of proving the validity of a statement without revealing the statement itself. It is a proof system with a prover, a verifier, and a challenge that gives users the ability to publicly share a proof of knowledge or ownership without revealing the details of it. They address privacy and security concerns, allowing selective disclosure without revealing underlying data.

Additionally, the concept of “MetaFi” emerges, which focuses on financial inclusion and regenerative finance within the decentralised Metaverse. It goes beyond replicating Wall Street’s excesses by tokenizing various forms of value, promoting digital cooperativism, and prioritizing mobile first experiences.

Besides, the decentralised Metaverse offers creators the opportunity to manage and monetize their digital media through NFTs. Creator controlled smart-contract middleware can help build a paradigm where any asset, including 3D objects built in game engines, to NPCs (Non Player Characters) and even prompts (for generating new assets through generative AI) become composable at the atomic level, with built-in perpetual royalties.

3. Non-Fungible Tokens

The NFT marketplace has become very popular over the past couple of years due to its promises of traceability, ownership, and distinctness. The total value traded in NFTs reached USD 17.6 billion in 2021, an unbelievable 21000% year-over-year increase from 2020, with 2.3 million buyers¹⁰. After that the NFT market generated around $24.7 billion worth of organic trading volume in 2022 across blockchain platforms and marketplaces. NFT market size is expected to become a USD 200+ billion market by 2030¹¹.

Despite the 2022 downfall, NFTs are still totaling close to $500 million in monthly sales volume¹². The use cases vary; from media and entertainment, to carbon markets, real estate, gaming, loyalty and rewards, and beyond. NFTs could serve as the medium of value exchange in the token economy. Because the tokens are unique, NFTs can be used for utility items such as land purchase as seen in Decentraland, as well as access tickets to various events in this space.

These unique features of NFTs made them attract the attention of notorious brands around the world, including Tiffany & Co, Nike and Budweiser¹³. Starbucks is also joining the web3 movement through the launch of their new NFT loyalty program as a way to promote the brand, improve customer engagement and experience. By offering members the ability to buy digital collectible stamps that are minted as NFTs on a blockchain, consumers are granted access to new, immersive experiences and online communities, and in turn increase loyalty and dedication to the brand. Not only is Starbucks able to leverage the technology to engage with their customers in new, meaningful, innovative ways, but customers are also able to better connect with each other and be part of a community of other brand loyalists.

4. Blockchain

Blockchain technology has evolved through multiple promising paths.

While blockchains historically have attempted to provide all four functional layers on one chain (execution, settlement, consensus & data availability) more recently there has been an increase in the number of solutions that offload portions of transaction data to help improve scalability and speed.

Some of the most popular are rollups, or Layer 2’s. These are side chains built on top of Ethereum that use the Ethereum mainnet as the settlement layer only. They can be thought of as a separate execution layer that sends bundles of transactions back to mainnet for verification.

Zero knowledge rollups, which are a huge step regarding privacy and scalability are mentioned in the metaverse section in this article.

Optimistic rollups are relatively new and they are a layer-2 scaling solution designed to enhance Ethereum’s throughput and latency by moving computation and data storage off-chain. Separate “Layer 2” blockchains that extend the base layer and inherit its security guarantees. Transactions are assumed to be valid, but can be challenged if necessary. These rollups reduce the load on the Ethereum mainnet and increase its scalability by processing transactions outside of it.

Another development is appchains, or application-specific blockchains, which are a customizable blockchain environment with their own consensus mechanism designed to help app makers create bespoke environments for projects.

But the most expected development came from Ethereum. A major Ethereum upgrade eliminated environmental objections about blockchain technology. Ethereum switched to energy-saving Proof of Stake (PoS) from energy-intensive Proof of Work (PoW) on September 15, 2022.

Use of blockchain to secure communication between IoT devices is also aa emerging topic. There are three key benefits of using blockchain for IoT:

1) Building trust between parties and devices, reduce risk of collusion and tampering.

2) Reduce costs by removing overhead associated with middleman and intermediaries.

3) Reduction and the acceleration of transactions.

There are lots of companies working on blockchain for IoT. For example Xage is the first blockchain-protected security platform for IoT. Focusing on industrial applications for industries like agriculture, energy, transportation and utilities, Xage’s blockchain enables IoT devices to be tamper proof and have access to secure lines of communication between smart objects. There is also IoTeX which has developed a blockchain-based platform that connects data and smart devices to blockchain dApps. The company’s product Ucam is the “world’s first blockchain home security camera,” combining blockchain and IoT to ensure users have secure access to footage captured in and around their homes.

5. Institutional Crypto Custody Services

As blockchain adoption accelerates in the financial markets, there is an increased demand for safe keeping of digital assets. Every new participant in the market needs a way to safely store and move their digital assets with the increasing fear of hacking and thefts. With growing institutional interest in digital assets, major players in the banking industry are trying to capture the market share and gain first mover advantage by partnering with niche players. BNP Paribas, ING, CitiBank, BNY Mellon are recent examples that partnered institutional digital asset custody platforms to serve their clients. As awareness of blockchain technology and cryptocurrencies grows, the role of institutional custodians becomes increasingly essential. Institutions will continue to look for solutions that ensure the safety of their assets.

Over time, as crypto has grown in popularity and practicality, institutions have expressed a willingness to invest in the asset class. A global study from Fidelity that surveyed over 1,000 institutional investors across Europe, Asia, and the United States, revealed that 81% of institutions believe that crypto should be a part of an institutional portfolio. Furthermore,74% of those institutional investors plan to invest in digital assets in the future¹⁴.

6. Alternative Asset Tokenization Classes

Tokenization has been a revolutionary blockchain-related use case for the financial services sector. Distributed Ledger Technology allows digital representation of any asset on the blockchain, streamlining the trade life cycle and eliminating the need for intermediaries. Tokenization enhances accessibility, transparency, cost-efficiency, and security of the trading system.

Also, perhaps an even more interesting application lies in fractionalization, where tokenization permits fractional ownership of high value assets. This has paved way for new asset classes including art, real estate, precious metals, which were previously difficult to trade.

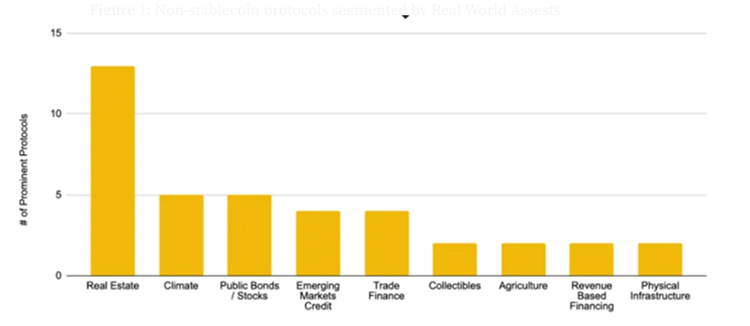

Figure 1: Non-stablecoin protocols segmented by Real World Assests underlying¹⁵

According to Figure 1, the asset class which serves as the most popular underlying for Real World Assests is real estate. This is followed by climate-related underlyings(e.g.carbon credits) and public bond/stock underlyings. Next,emerging market credit (mainly corporate debt) underlyings and so on.

Tokenisation of assets involves the digital representation of real (physical) assets on distributed ledgers,or the issuance of traditional asset classes in tokenised form. The application of DLTs and smart contracts in asset tokenisation has the potential to deliver a number of benefits, including efficiency gains driven by automation and disintermediation; transparency; improved liquidity potential and tradability of assets with near-absent liquidity by adding liquidity to currently illiquid assets; faster and potentially more efficient clearing and settlement. It allows for fractional ownership of assets which, in turn, could lower barriers to investment and promote more inclusive access by retail investors to previously unaffordable or insufficiently divisive asset classes, allowing global pools of capital to reach parts of the financial markets previously reserved to large investors. The flow of private financing from capital owners to SMEs could be eased and facilitated, enhancing access to financing for SMEs.

Conclusion

Blockchain has the power to change how people do business across the globe, especially in growth markets. The blockchain adoption in financial services made significant progress since its early days. CBDCs will disturb national and international currency exchange mechanisms, digital assets will revolutionize capital markets, while cryptocurrencies will continue to exert pressure as an alternative means for payment.

Expectations are high for tokenized RWAs also, with securitized assets, commodities, real estate, public bonds, private debt, derivatives markets and carbon markets.

The metaverse and ticketing are the top use cases for utility-based NFTs. The business use of NFTs across both instances is primarily around secure, tamper-proof, transparent records of ownership and a means of bridging physical and digital experiences and transactions. The expected amount of NFT-related metaverse transactions is gaining traction and attracting people around the world.

Gaming has certainly been critical in seeding the metaverse with platforms such as Decentraland, Sandbox, and Axie Infinity, but the metaverse has other applications in verticals other than gaming, such as fitness, education, entertainment and commerce, and it will likely create new opportunities and enhance experiences in ways that are additive to what the Internet has enabled thus far.

Overall, web3 is widely recognized as a game-changing industry with many

advantages. Its potential applications have gone beyond trading cryptocurrencies and are now popular in various sectors, including healthcare, e-commerce, publishing, finance, and insurance. All of these implementations are driving innovation and generating value by increasing the speed and efficiency of traditional processes in various fields and industries.

https://medium.com/@gokhan.ozdemir/top-web3-trends-of-2023-3d44aeb7dff2

References

Federal Reserve Bank of New York, 2022. New York Fed and Monetary Authority of Singapore Collaborate to Explore Potential Enhancements to Cross-Border Payments Using Wholesale CBDCs [Press Release]. https://bit. ly/3BzgCqN

Denicker, O. et al. Central bank digital currencies: An active role for commercial banks, McKinsey Research, 2022. https://bit.ly/3ptH2ar

Juniper Research. CBDCs & Stablecoins: Key Opportunities, Regional Analysis and Market Forecasts 2023–2030. https://bit.ly/42y4AJP

https://www.gartner.com/en/newsroom/ press-releases/2022–02–07-gartner-predicts- 25-percent-of-people-will-spend-at-least-one-hour-per-day-in-the-metaverse-by-2026

https://www.voguebusiness.com/ technology/nike-and-rtfkt-take-on-digital-fashion-with-first-cryptokick-sneaker

https://news.bitcoin.com/ mastercard-files-15-trademark-applications-for-a-wide-range-of-metaverse-nft-services/

https://news.bitcoin.com/fidelity-investments-launches-crypto-metaverse-etfs-says-we-continue-to-see-demand/

https://fortune.com/2022/04/01/ citi-metaverse-economy-13-trillion-2030

https://www.cnbc.com/2022/03/10/ trading-in-nfts-spiked-21000percent-to-top- 17-billion-in-2021-report.html

https://www.globenewswire.com/en/news-release/2022/05/27/2451899/28124/en/ Non-fungible-Token-NFT-Global-Market- Growth-Forecasts-A-211-Billion-Market-by- 2030-with-CAGR-of-33-During-2022–2030. html

Dale, B. “NFTs are down, but they’re not dead” Axios, 2023. https://bit. ly/44SgMHc

a16z. State of Crypto 2023. https://bit.ly/3LW14SE

https://www.fidelitydigitalassets.com/sites/default/files/documents/2022_Institutional_Investor_Digital_Assets_Study.pdf

https://research.binance.com/static/pdf/real-world-asset-report.pdf

https://research.binance.com/static/pdf/real-world-asset-report.pdf